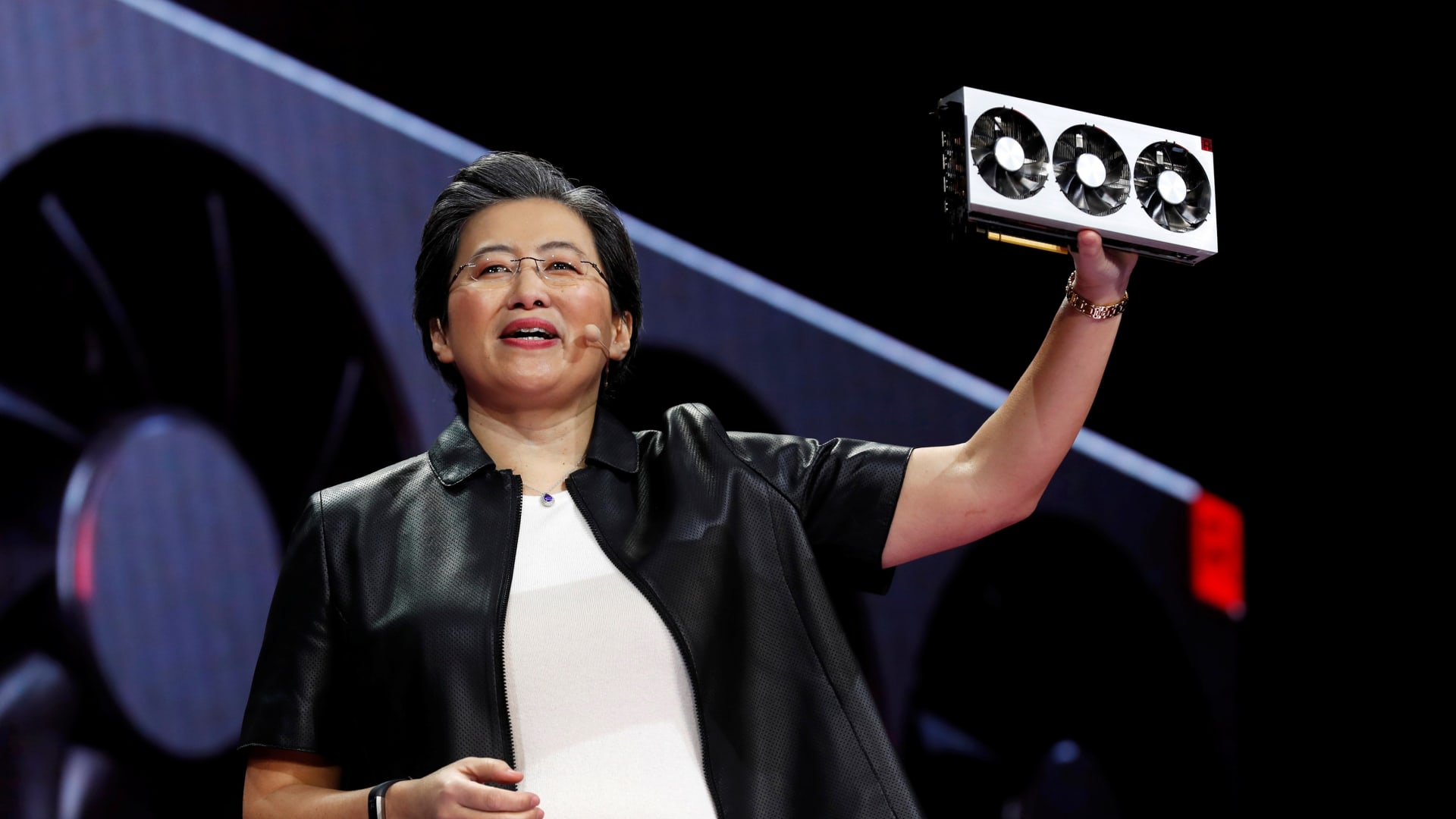

Lisa Su, president and CEO of AMD, talks about the AMD EPYC processor during a keynote speech at the 2019 CES in Las Vegas, Nevada, USA, January 9, 2019.

Steve Marcus | Reuters

Advanced Micro Devices reported profit and sales for the first quarter on Tuesday, which were slightly ahead of Wall Street expectations and provided an outlook for the current quarter.

Shares fell 7% in extended trading.

Here’s how it fared against LSEG consensus expectations for the quarter ended in March:

- Earnings per share: 62 cents adjusted vs. 61 cents expected

- income: $5.47 billion vs $5.46 billion expected.

AMD said it expects about $5.7 billion in sales in the current quarter, in line with Wall Street forecasts for the same approximate amount. This would represent about 6% annual growth.

The company reported net income of $123 million, or 7 cents per share, compared with a net loss of $139 million, or 9 cents per share, in the prior period. Revenues were up about 2% from a year earlier.

AMD shares are up 14% in 2024, so despite beating estimates and signaling growth in AI chip sales, Tuesday’s results weren’t enough to prevent the stock from falling.

The chipmaker said its closely watched data center segment grew 80% year-over-year to $2.3 billion, thanks to sales of its MI300 series of AI chips that compete with Nvidia’s GPUs.

CEO Lisa Su said Microsoft, Meta and Oracle use AMD’s MI300X. AMD said it has sold more than $1 billion of the chips since they went on sale in the fourth quarter of 2023.

AMD expects $4 billion in AI chip sales in 2024, up from a forecast of $3.5 billion in January. By comparison, Nvidia, the largest supplier of AI server chips, reported $18.4 billion in sales — mostly AI chips — in its data center segment alone for the January quarter, the latest for which financial results are available.

Su told investors on Tuesday that the company is working on new AI chips and successors to the current generation. “We are getting much closer to our best AI customers. They actually give us significant feedback on the roadmap,” Su said.

AMD also makes CPUs that are often combined with advanced AI chips in servers. Su told analysts on a call that the company believes it has captured market share in the server processor segment — possibly from Intel. Su said AMD is seeing “signs of improving demand” for its processors due to the AI server boom.

AMD’s weakest division was its gaming segment, which saw a 48% year-over-year drop to $922 million, which the company said was due to lower sales of chips for game consoles and PCs. AMD makes chips for Sony’s PlayStation 5, for example. AMD’s gaming sales fell short of StreetAccount’s estimate of $969 million.

AMD’s original business, processors for chips and PCs, is reported as customer segment revenue. AMD reported $1.4 billion in first-quarter sales, an 85% year-over-year increase that suggests last year’s PC slump is over. AMD’s computer processors can run artificial intelligence programs locally, which will allow them to power the so-called “artificial intelligence computers” that many industry players are banking on to drive sales of new laptops and desktops.

The company’s embedded devices segment, made up of products acquired as part of its 2022 acquisition of Xilinx, reported a decline in sales, falling 46% year over year to $846 million, missing Wall Street expectations for $942 million.

https://www.cnbc.com/2024/04/30/amd-gaming-revenue-falls-48percent-year-over-year-and-the-stock-is-down.html