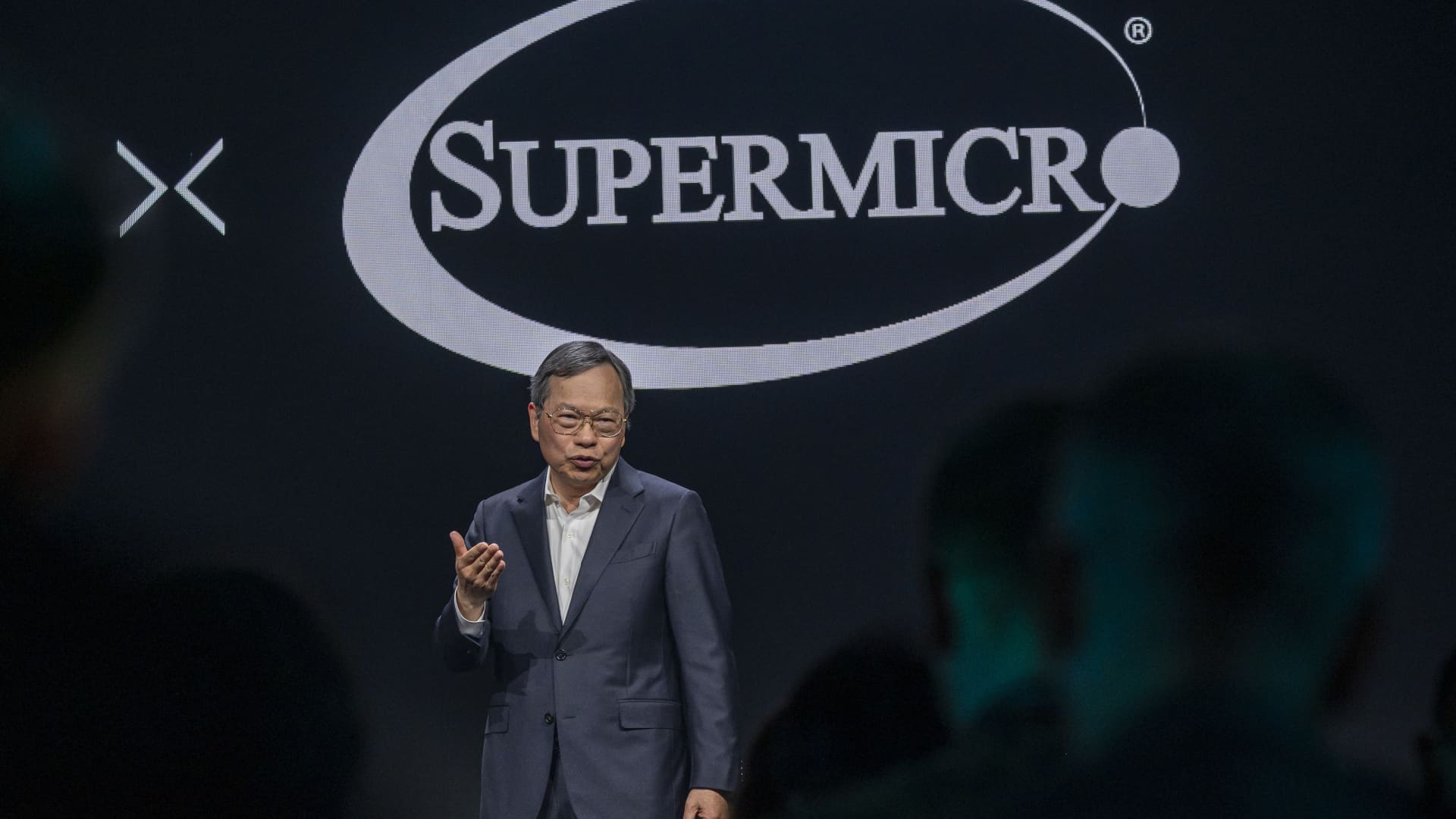

The Super Micro Computer logo is seen on a smartphone screen.

Pavlo Gonchar | SOPA Images | Lightrocket | Getty Images

Super micro computer shares fell 15% on Wednesday after the server company raised its top-line guidance but reported third-quarter revenue that slightly missed estimates.

On Tuesday, the company reported revenue of $3.85 billion, below the $3.95 billion expected by analysts polled by LSEG. Adjusted earnings of $6.65 per share beat analysts’ expectations of $5.78 per share.

Super Micro raised its fiscal 2024 revenue forecast to between $14.7 billion and $15.1 billion, beating the $14.6 billion expected by LSEG.

In 2023, the stock jumped 246% on investor hopes that Super Micro, which competes with companies including Dell and Hewlett Packard Enterprisecan be a major server provider for Nvidiawhose GPUs drive powerful AI models.

Super Micro joined the S&P 500 in March. Its shares are still up 156% this year.

Analysts at Bank of America reiterated their buy rating on Super Micro, while lowering their price target from $1,280 to $1,090, writing in a note to investors on Wednesday that their “bullish thesis remains intact,” citing the company’s favorable guidance and the ability to capture demand from other chip makers beyond Nvidia, among other factors.

“Super Micro remains a pure AI server provider for gaming, and we expect continued positive revisions to forecasts over the long term,” the analysts wrote.

Analysts at JPMorgan, who rated the stock as overweight with a $1,150 target price, praised Super Micro’s business outlook, writing that it “doesn’t leave much to worry about” about supply and demand gains. Still, they discussed concerns about the company’s willingness to sacrifice margins and the need for more capital increases that could dilute earnings.

“We continue to be positively surprised by strong revenue momentum and sustained demand momentum across the industry, with Super Micro’s growth cementing its solid market leadership position,” analysts wrote in a Tuesday note.

Also on Tuesday, analysts at Wells Fargo, maintaining an equal rating on Super Micro stock, cut their price target to $890 from $960. Analysts at Barclays maintained a neutral rating and raised their price target to $1,000 from $961.

“SMCI maintains a strong competitive moat based on our supply chain checks,” Barclays analysts wrote.

— CNBC’s Michael Bloom contributed to this report.

https://www.cnbc.com/2024/05/01/super-micro-stock-plummets-18percent-after-posting-revenue-miss-.html