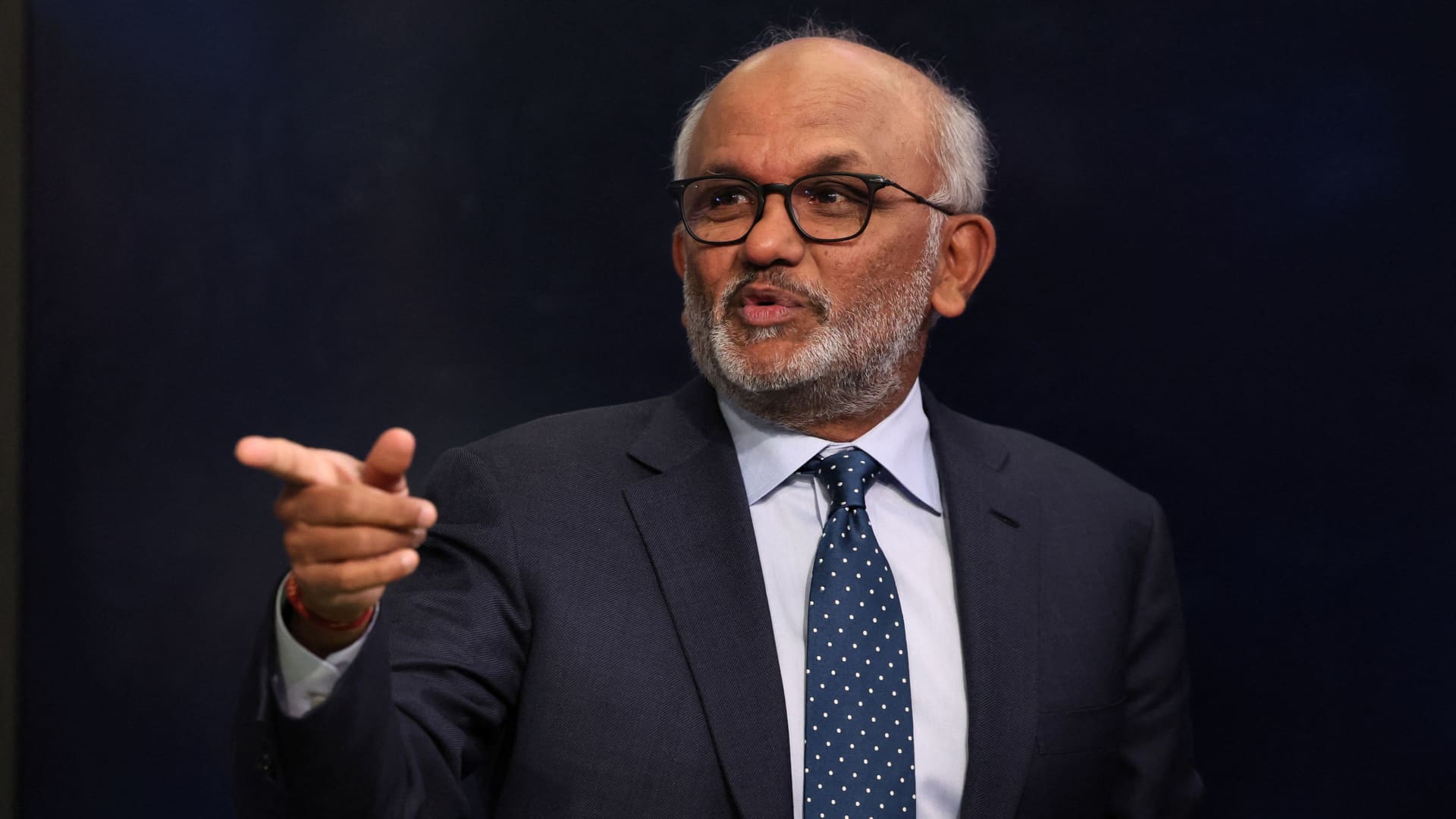

Adobe CEO Shantanu Narayen speaks during an interview with CNBC on the floor of the New York Stock Exchange in New York, February 20, 2024.

Brendan McDermid | Reuters

Adobe shares fell 13% on Friday morning after the company reported first-quarter results that beat estimates but provided a soft forecast for quarterly revenue.

The design software company posted adjusted earnings per share of $4.48, above the $4.38 analysts were expecting, according to LSEG, formerly Refinitiv. Its revenue of $5.18 billion beat analysts’ estimate of $5.14 billion.

For the current quarter, Adobe expects adjusted earnings per share of $4.35 to $4.40, while analysts were expecting $4.38. He said revenue would come in at $5.25 billion to $5.30 billion, slightly below estimates of $5.31 billion. The company also announced a $25 billion share buyback.

Adobe also recently released a new AI assistant for its Reader and Acrobat apps that can help users digest information from long PDF documents.

Analysts at Bank of America, reiterating their buy rating on Adobe shares, cut their price target on the stock to $640 from $700, expressing optimism about Firefly, the company’s generative AI imaging tool.

“There is no change in our view that Adobe is a major beneficiary of AI,” the analysts wrote in a note to investors on Thursday. “Although monetization growth has been slower than expected, Firefly is one of the [most] widely used generative AI offerings, with the potential for multiple avenues of monetization.”

Barclays cut its price target on Adobe shares to $630 from $700, while maintaining an overweight rating on the stock. Its analysts wrote on Friday that they expect the stock to recover and “will buy this dip because pricing masks Creative Cloud’s core strength.”

Analysts at Morgan Stanley maintained their overweight rating and $660 price target on Adobe shares, writing on Friday that “more patience is likely warranted.”

“A smaller-than-expected hit in Digital Media Net New ARR likely adds to investor concerns about competitive pressures,” the analysts wrote. “However, the growing number of GenAI monetization vectors and new monetizable solutions coming online in 2H24 should help improve the narrative going forward.”

https://www.cnbc.com/2024/03/15/adobe-shares-drop-12percent-on-weak-quarterly-revenue-guidance-.html