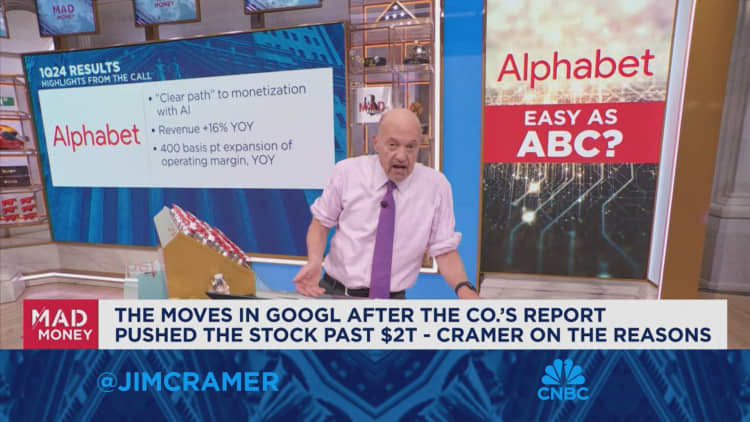

Google’s business grew at its fastest pace in two years, and Google’s April earnings report sparked the biggest increase in Alphabet shares since 2015, pushing the company’s market capitalization past $2 trillion.

But in a joint meeting last week with CEO Sundar Pichai and CFO Ruth Porath, officials were more focused on why that performance isn’t translating into higher pay and how long the company’s cost-cutting measures will be in place.

“We have seen a significant drop in morale, increased mistrust and a lack of connection between management and the workforce,” said a comment posted on an internal forum ahead of the meeting. “How does management plan to address these concerns and regain the trust, morale and cohesion that underpin our company’s success?”

Google uses artificial intelligence to aggregate employee comments and questions about the forum.

Alphabet’s top management has been on the defensive for the past few years as vocal employees have fumed over post-pandemic back-to-the-office mandates, the company’s cloud contracts with the military, fewer bonuses and a prolonged period of layoffs — totaling more than 12,000 last year. year — along with other spending cuts that began when the economy turned around in 2022.

Employees also complain of a lack of trust and being required to work to shorter deadlines with fewer resources and reduced opportunities for internal advancement.

The infighting continued despite Alphabet’s better-than-expected first-quarter earnings report, in which the company also announced its first dividend and a $70 billion buyback.

“Despite the company’s stellar performance and record profits, many Googlers have not received a meaningful increase in compensation,” reads a top-rated employee question. “When will employee compensation fairly reflect the company’s success, and is there a conscious decision to keep wages lower because of a cooling labor market?”

Another highly rated comment focused on the company’s priorities, including its massive investment in artificial intelligence.

“For many people, there is a clear difference between spending billions on share buybacks and dividends and reinvesting in AI and retraining critical Google employees,” the post said.

Ruth Porath, Alphabet’s chief financial officer, appears at a panel session at the World Economic Forum in Davos, Switzerland, on May 24, 2022.

Holly Adams | Bloomberg | Getty Images

“Our priority is to invest in growth,” Porat said as he took the microphone to answer questions. “Revenue must grow faster than spending.”

It also took the rare step of acknowledging management’s mistakes in previous investment management.

“The problem is a couple of years ago — two years ago to be exact — we actually turned it upside down and expenses started growing faster than revenue,” said Porath, who announced nearly a year ago that she would step down from the position of CFO, but hasn’t left the office yet. “The problem with that is it’s not sustainable.”

Google executives have been wading into this topic lately.

Search chief Prabhakar Raghavan outlined Google’s main business challenges in an internal meeting last month, saying “things are not like they were 15 to 20 years ago” and urging employees to work faster. He told his team, “It’s not like life is going to be carefree forever.”

Google’s cloud business was among the units that instructed staff to move within tighter deadlines despite having fewer resources after cost-cutting.

Using Google Cash

There were many questions from employees before last week’s meeting aimed at buying back the company, Porath said.

As of the most recent quarter, Alphabet had more than $100 billion in cash on the balance sheet, but, Porat said, “you can’t just drain it” or the company will find itself in the same position it was in 2022.

In contrast, distributing cash to shareholders is not considered an expense on the balance sheet, she said, adding that the board has a fiduciary duty to consider such measures. Buybacks and dividends are not a substitute for investment in AI, Porath said.

Pichai chimed in as Porat finished his answer.

“I think you almost set the record for longest TGIF response,” he said. Google All Hands Meetups were originally called TGIFs because they were held on Fridays, but now can be held on other days of the week.

Pichai then joked that management should hold a Ted Talk “Finance 101” for employees.

Regarding the drop in employee morale, Pichai said “management has a lot of responsibility here,” adding that “it’s a repetitive process.”

Pichai said the company had overstaffed during the Covid pandemic.

“We hired a lot and had a course correction from there,” Pichai said.

The number of full-time employees at Alphabet rose to more than 190,000 at the end of 2022, up almost 22% from a year earlier and up 40% from the end of 2020.

Pichai, who replaced the Google co-founder Larry Page, as CEO of Alphabet in 2019, has taken his share of criticism recently for his messages to the workforce, as well as his high pay package, which swelled to $226 million, including stock awards, in 2022.

The 2022 package included $218 million in stock through a three-year stock grant. His total salary in 2023 was $8.8 million, up from about $8 million the previous year (not including the stock grant), according to Alphabet’s submission of power of attorney. Besides Pichai’s $2 million salary for each year, most of his additional compensation was for personal security.

Employees have complained about the level of Pichai’s compensation at a time when the company is downsizing.

“Given recent headcount and positive earnings, what is the company’s headcount strategy?” one question read. Another asked: “Given the strong results, are we done cutting costs?”

Pichai said the company is “working through a long period of transition as a company” that includes cutting costs and “driving efficiencies.” On the latter point, he said, “We want to do this forever.”

“To be clear, we are increasing our spending as a company this year, but we are slowing our growth rate,” Pichai said. “We see opportunities where we can redeploy people and get things done.”

A Google spokesperson reiterated to CNBC that the company is investing in its highest priorities and will continue to hire in those areas.

The spokesman also said that most employees will receive a pay rise this year, including a salary increase, equity grants and a bonus. Executives at the general meeting said that employees who received raises last year received smaller raises than usual.

Another comment that appeared before the meeting was related to “growing concerns about jobs moving from the US to lower-cost locations.” CNBC reported last week that Google is cutting at least 200 employees from its “Core” organization, which includes key teams and engineering talent.

Executives were asked about the continued layoffs despite the strong earnings report and “when can we expect an end to the uncertainty and disruption created by the layoffs?”

Pichai said the company will have gone through most of the layoffs in the first half of 2024.

“Assuming current conditions, the second half of the year will be much smaller in scale,” Pichai said, referring to the job cuts. He said he would continue to be “very, very disciplined about managing staff growth throughout the year.”

This means that the company is still making tough choices regarding investments in new projects.

“There’s a lot of demand to do new things, and in the past we would have done it reflexively by increasing the number of employees,” Pichai said. “We can’t do it now through the transition we’re in.”

WATCHING: Alphabet’s investor call had a “remarkable” level of transparency, says Jim Cramer

https://www.cnbc.com/2024/05/08/google-staffers-question-execs-over-decline-in-morale-after-earnings.html