Qualcomm, a leading American semiconductor company, recently confirmed that Huawei, the Chinese telecommunications giant, no longer needs its processors. The announcement comes amid ongoing tensions between the United States and China over trade and technology restrictions. The confirmation from Qualcomm’s CFO that Huawei will not buy 4G chips from the company in the future underscores the significant shift in the global technology landscape.

Huawei – Qualcomm Business History

The relationship between Huawei and Qualcomm has been marked by both cooperation and competition over the years. Huawei, founded in 1987 by Ren Zhengfei, initially focused on manufacturing telecommunications equipment and gradually expanded its operations globally. The company’s rise to prominence was supported by the Chinese government through loans and policies favoring local companies, allowing Huawei to compete effectively in the telecommunications equipment market. On the other hand, Qualcomm, established in 1985, is a key player in the wireless communications and semiconductor industry. The company’s innovations, such as the development of CDMA technology in 1989 and the introduction of the Snapdragon processor in 2007, have significantly shaped the mobile technology landscape.

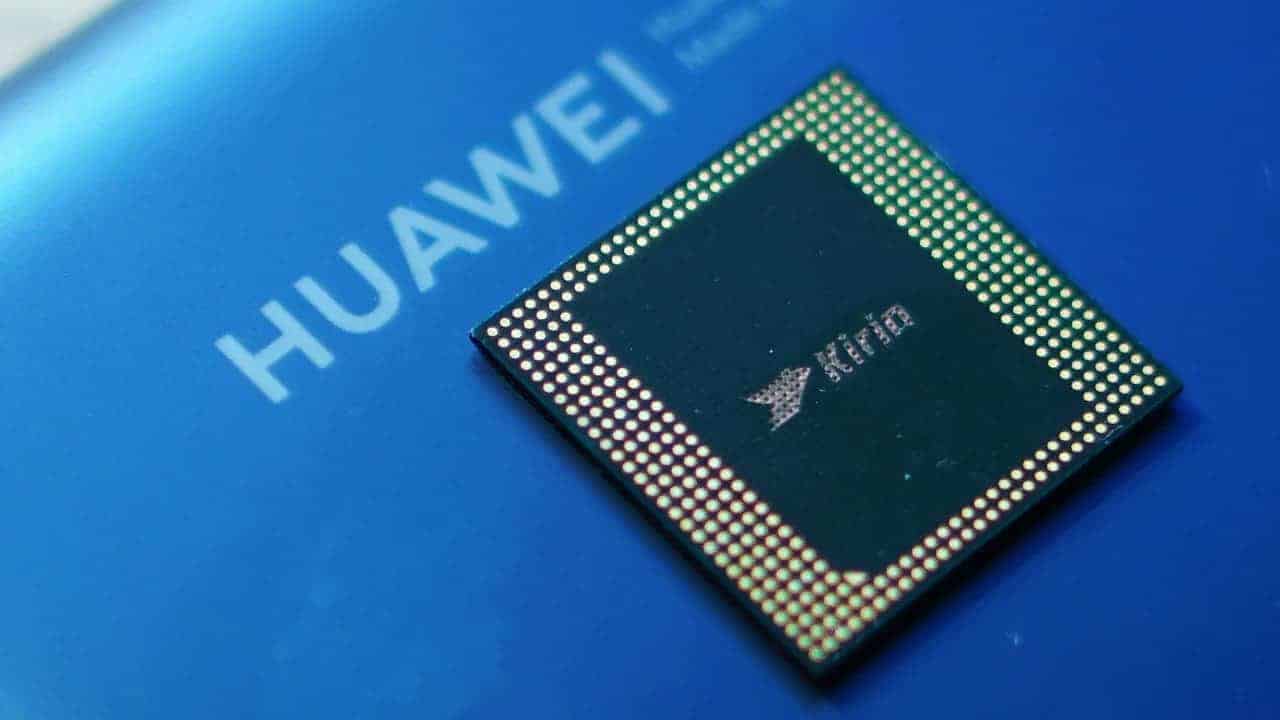

The relationship between Huawei and Qualcomm took a competitive turn as Huawei began producing its own processors and modems, directly competing with Qualcomm’s products. This competition has intensified as Huawei has invested heavily in 5G communications technology, becoming one of Qualcomm’s main rivals in this space. However, after the US ban on Huawei, the Chinese brand no longer had access to key technologies it needed to manufacture its chips. For this reason, it had to rely on Qualcomm chips for several years. However, it only had access to Qualcomm’s 4G chips.

Huawei’s transition to independence

Huawei’s decision to move away from Qualcomm processors is a strategic move towards independence. The company is actively working on the development of its own chipsets, especially on Kirin series, which is used in its smartphones. This change is seen as a response to ongoing trade tensions and restrictions imposed by the United States on Huawei’s access to advanced technologies and components.

Huawei’s move to independence can be seen in its latest flagship phones, the Huawei Pura 70 series. According to reports, this series uses more components made in China than parts from the rest of the world combined. The move is in line with Huawei’s strategy to reduce its dependence on foreign suppliers and improve its self-sufficiency in the wake of US sanctions and trade restrictions. The Pura 70 Ultra and Pura 70 Pro models of the series come with a set of components from China. This includes memory chips and the advanced Kirin 9010 processor.

Gizchina News of the week

The impact of export restrictions is diminishing

The withdrawal of the export licenses of Qualcomm and Intel, two major US chipmakers, will have a limited impact on Huawei’s mobile phone processors. This is because Huawei already has its own Kirin chipsets that it uses in its smartphones. In addition, the company is working on expanding its Kirin technology to other important terminals, such as notebook computers, to reduce its dependence on Intel.

Huawei is also developing a Kirin PC version of the processor. This chip should be more powerful than mobile chips similar to Apple’s “Pro” and “Max” versions. The new chip should come with multi-core performance close to that of the M3, making it a worthy competitor in the market.

Huawei’s growth amid challenges

Despite the challenges posed by ongoing trade tensions and restrictions, Huawei has continued to grow and expand its operations. The company reported a significant increase in revenue in 2023, with total revenue of almost $100 billion. This growth is due to Huawei’s focus on developing its own technology and reducing dependence on foreign components.

Huawei’s Q1 2024 mobile phone shipments and revenue showed significant growth. According to reports, Huawei’s net profit for the first quarter of 2024 is approximately 19.65 billion yuan (about $2.8 billion), representing a 564% year-on-year increase. This jump in profit was largely due to the company’s strong performance in the Chinese smartphone market. Huawei is at the top of the Chinese mobile phone market in terms of mobile phone shipments. Huawei’s mobile phone shipments in China increased by 70% in the first quarter of 2024, contributing to its overall growth.

![]()

Conclusion

Qualcomm’s confirmation that Huawei no longer needs its chips marks a shift in the global technology landscape. Huawei’s decision to move away from Qualcomm processors and develop its own chipsets is a strategic move towards independence and a response to ongoing trade tensions.

Huawei’s strategic shift to using its Kirin processors in its smartphones from 2024 could have an impact on Qualcomm. This could lead to a drop in Qualcomm’s supply of Chinese smartphone brands. The move by Huawei reflects a broader trend of the company seeking greater independence and less dependence on foreign suppliers, particularly in response to trade tensions and restrictions imposed by the United States.

Despite challenges due to export restrictions and bans, Huawei has shown resilience and growth, reporting a significant increase in revenue in 2023 and a remarkable jump in net profit for the first quarter of 2024. The company’s focus on developing its technologies, including Kirin chipsets, contributed to its continued success and expansion, especially in the Chinese smartphone market, where Huawei regained its position as a leading player in terms of mobile phone shipments. What do you think of Huawei’s resilience in the mobile phone market? Has the company performed well despite numerous bans? Let us know your thoughts in the comments section below

:max_bytes(150000):strip_icc()/Health-GettyImages-1344937456-050f0adfa4b64287b92e93653811b9ff.jpg)