A Tesla car drives past a store of the electric vehicle (EV) maker in Beijing, China, 4 January 2024.

Florence Law | Reuters

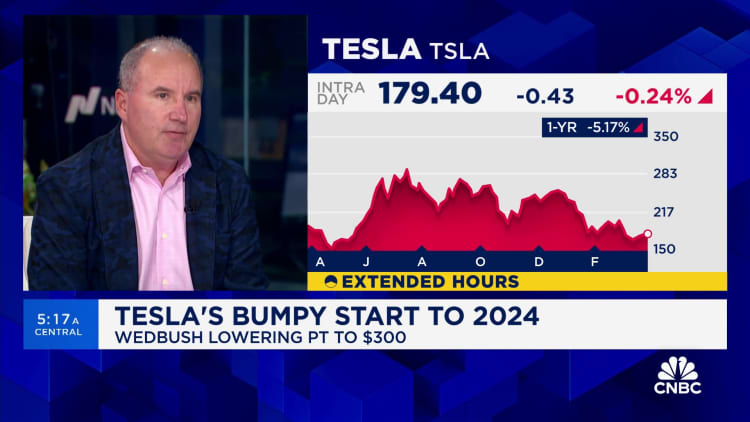

It was a brutal first quarter for Tesla investors.

Shares of the electric vehicle maker fell 29% in the first three months of the year, the worst quarter for the stock since late 2022 and the third worst since Tesla went public in 2010. It was also the biggest loser in the S&P 500 .

Chief among Wall Street’s concerns is Tesla’s core business. The company is set to report first-quarter vehicle production and deliveries in the coming days, and even the bulls expect sluggish results despite price cuts and buyer incentives hanging over the quarter.

As of Thursday, the last trading day of the quarter, analysts had expected about 457,000 shipments for the period, according to the average estimate of 11 analysts compiled by FactSet. That would mark an 8% increase from 422,875 a year earlier. Estimates for the quarter ranged from 414,000 to 511,000 deliveries.

Analysts who updated their numbers in March were the most bearish, with estimates ranging from 414,000 to 469,000. Independent auto industry researcher Troy Teslike expects the company’s deliveries to come in below even the lowest estimate captured by FactSet .

The deliveries are the closest approximation of sales reported by Tesla, but are not precisely defined in the company’s shareholder announcements.

Here are four main reasons for Tesla’s decline in the first quarter.

Ruthless competition in China

There is competition in China from the onslaught of all-electric vehicles, including new models that cost less than Tesla’s popular Model Y SUV and Model 3 sedan.

Chinese smartphone company Xiaomi is getting into the game with its first vehicle, an all-electric SUV that costs a lot less than Tesla’s base Model 3 sedan. Xiaomi CEO Lei Jun said the standard version of the SU7 will sell for the equivalent of $30,408 in China, a price he admitted would mean the company loses money on every sale. The Tesla Model 3 is approx $4000 more from this.

Tesla cut prices in response, but sales were still slow.

According to data from the China Automobile Association, Tesla sold 71,447 of its China-made cars in January, including 39,881 sold domestically, a decline from December. The numbers fell again in February to 60,365 Chinese-built Teslas, including exports.

As sales fell, Tesla cut production at its Shanghai factory, moving staff from working six-and-a-half days a week to five days, Bloomberg reported for the first time.

Tesla didn’t offer guidance for 2024 in its January earnings call, but analysts see Tesla’s struggles in China as a harbinger of a tough quarter, if not the full year.

Deutsche Bank analyst Emmanuel Rosner cut his price target on Tesla this week, citing weaker-than-expected sales in China and the company’s recent plan to cut production in the region. Rosner now expects Tesla to report deliveries of 414,000 for the first three months of 2024 and forecasts only mid-single-digit growth for the year from Tesla.

Attacks in the Red Sea, activist clashes in Europe

There was also drama in Europe.

Tesla and other manufacturers such as Volvo halted some production on the continent in January due to component shortages following attacks on shipping companies in the Red Sea. Attacks by Iran-backed Houthi militias continue to disrupt one of the world’s busiest routes.

Elon Musk, CEO of Tesla Inc., arrives at the Tesla factory in Gruenheide, Germany on March 13, 2024.

Christian Bossi | Bloomberg | Getty Images

Then in March came a dramatic protest by environmentalists in Germany. Objecting to Tesla’s plans to expand the footprint of its car and battery factory in Brandenburg, outside Berlin, protesters set fire to electrical infrastructure near the Tesla plant. Although the fire did not spread to the factory, it left the facility without enough power for operations, forcing a temporary shutdown of production.

CEO Elon Musk visited the German factory after the attack to reassure employees. He also called the protest “extremely dumb.” Tesla’s head of policy, Rohan Patel, wrote to X that Tesla’s mission is to “create zero-emissions products,” but to do that well, “we also focus on creating the most sustainable factories along with a culture of doing the right thing in our community.”

Meanwhile, in the Scandinavian countries, Tesla service technicians and other workers went on strike in support of Swedish trade union IF Metall. The labor group has been pressuring Tesla since October 2023 to negotiate and sign a collective bargaining agreement with its workers.

IF Metall’s website says nine out of 10 workers are members of unions in Sweden, but Tesla resists unions, as it consistently does in the US, and rejects IF Metall’s efforts to negotiate.

Aging lineup, early days for the Cybertruck

Although EV sales are still gaining traction globally, the rate of growth has slowed. And with Tesla no longer the dominant player, each new product becomes more and more important. There isn’t much in the bunker.

Cybertruck is still in its infancy and has a niche audience. The company began shipping the angular, unpainted steel model of the truck in December at a promotional event in Austin, Texas.

Earlier, Musk said during an earnings call that Tesla had “dug its own grave” with the sci-fi-inspired Cybertruck. In an interview with Tesla fan and auto critic Sandy Munro in late 2023, Musk warned that “Cybertruck is not something that will be material to Tesla’s financials” in 2024 and “probably will be material in 2025 .”

A Tesla Cybertruck at a Tesla store in San Jose, California on November 28, 2023.

Bloomberg | Bloomberg | Getty Images

Tesla is gearing up production of its updated Model 3, known as the Highland, in Fremont, California. Larry Magid of Forbes wrote, “Visually, the exterior changes are subtle.” He also disliked Tesla’s controversial design decision to omit the “stems” on the side of the steering wheel. Highland drivers use buttons and on-screen controls to switch between drive, reverse and park, or to signal a turn or lane change.

Tesla does have an entirely new platform in development, a more affordable EV that fans are calling the “Model 2.” But it won’t be delivered to customers for years.

Masculine control and controversy

Musk continues to bet that Tesla customers and shareholders will stick with the company despite his increasingly inflammatory rhetoric about the X and beyond.

Earlier this month, Musk met with the former president Donald Trump in Florida. He is called upon to “red wave” in the upcoming US election, and he has shared, liked or otherwise promoted far-right accounts and content on X, where he now has 178.8 million listed followers. He has repeatedly disparaged undocumented immigrants, railed against corporate diversity initiatives and has made absurd claims that Haitian migrants are cannibals.

Musk’s political ideology is at odds with groups of people most likely to buy his products. Proponents of electric vehicles tend to be ideologically left-wing, according to a study by the Pew Research and Gallup last year.

Musk also bet that Tesla’s shareholders and its board of directors would follow suit. In February, Musk said he would propose a shareholder vote to move Tesla’s Texas headquarters from Delaware after a Delaware judge voided the $56 billion pay package he was awarded in 2019 on the grounds that the board failed to prove “the compensation plan was fair.”

Before the decision, Musk had begun pressuring Tesla’s shareholders and board of directors to give him more control over the electric car maker.

“I am uncomfortable developing Tesla as a leader in AI and robotics without having ~25% voting control,” Musk wrote in a post in January.

Investor Ross Gerber, a longtime Tesla bull, called the demand tantamount to “blackmail” in the CNBC interview.

Bears are cleaning

All of this adds up to over $230 billion in lost market cap for Tesla and its shareholders since the calendar turned to 2024. That made for a very lucrative quarter for short sellers who expected such a decline.

According to data from S3 Partners, Tesla’s shorts are worth more than $5.77 billion in 2024, making it the most profitable name in the US. Short interest at the close of trading on Thursday was about 3.76% of the float, representing $18.71 billion in notional value.

Brad Gerstner of Altimeter Capital is buy dip. Gerstner told CNBC this week that the company is making “tremendous progress at an accelerating rate” in its self-driving technology efforts.

Musk has been making similar statements for years. In 2015, he told shareholders that by 2018, Tesla cars would achieve “full autonomy” and be able to drive themselves. In 2016, he said that Tesla would be able to send one of its cars to drive without human intervention by the end of next year.

Tesla has yet to deliver robotics, an autonomous vehicle, or technology that can turn its cars into Level 3 automated vehicles. However, Tesla does offer advanced driver assistance systems (ADAS), including a standard Autopilot or premium option a fully self-managed “FSD” option, the latter of which costs $199 per month for US subscribers or $12,000 up front.

In a push for end-of-quarter sales, Musk recently ordered all sales and service personnel to install and demonstrate FSD for customers before they hand over their cars. He wrote in an email to employees: “Almost nobody really realizes how well (controlled) FSD actually works. I know this will slow down the delivery process, but it’s a tough request nonetheless.”

Despite its name, Tesla’s premium option requires a human driver behind the wheel, ready to steer or brake at any time.

WATCHING: Tesla goes through ‘code red’

https://www.cnbc.com/2024/03/29/tesla-stock-drops-29percent-in-first-quarter-as-global-dominance-wanes.html