According to the latest report by Counterpoint Research, global smartphone market posted a healthy 6% year-over-year increase in shipments in the first quarter of 2024, reaching 296.9 million units. This marks the third consecutive quarter of growth, indicating a strong recovery in the industry. As expected, major smartphone brands performed well.

Samsung is back on top

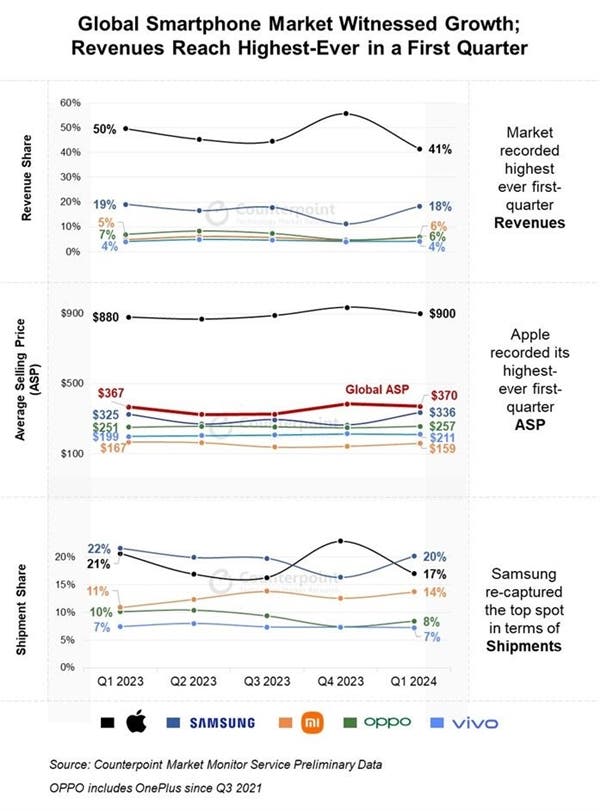

Leading the pack is Samsung, which has regained its position as the world’s number one smartphone brand. The South Korean tech giant captured a 20% market share, shipping 59.4 million units in the first quarter of 2024. That’s a solid performance, especially considering the heavy inventory build-up that affected the previous quarter.

After being pushed into second place by Apple in the previous quarter, Samsung jumped ahead with impressive sales figures, especially thanks to the successful launch of the Galaxy S24 series. The Galaxy S24 series, which introduced innovative AI features and received positive reviews in the North American market, played a key role in Samsung’s revival. The company’s strategic focus on premium phones, which are more profitable, has paid off, with Samsung planning to further dominate the premium phone market by using a lawsuit filed by the US Department of Justice against Apple for alleged antitrust violations.

Samsung’s market share in Europe and the United States has seen significant growth, with the Galaxy S24 series being a key driver of this success. The company’s presence in the premium phone segment coupled with the positive response to its foldable phones has cemented its position as the leading smartphone brand globally. Samsung’s ability to adapt its strategies, launch innovative products and take advantage of market opportunities has brought it back to the coveted number one spot, demonstrating its resilience and competitiveness in the dynamic smartphone industry.

Apple lost the top spot and settled for number 2

In contrast, Apple, the previous market leader, saw its shipments decline by 13% year-on-year, falling to second place with 17% market share. The tech giant shipped 50.5 million iPhones in the quarter, a significant drop from the same period last year. A major contributing factor to Apple’s performance woes was the large inventory backlog that plagued the company in the previous quarter. This inventory build-up, coupled with a lack of major product launches, appears to have taken a toll on Apple’s ability to maintain its momentum in the global smartphone market.

Xiaomi leads the Android camp with impressive growth – basking in the euphoria of N0. 3

While the top two spots were dominated by industry heavyweights, the Android camp also saw some notable results. Xiaomi, the Chinese smartphone maker, emerged as the fastest-growing brand among the top five, with a 34% increase in shipments year-on-year. The company shipped 41.5 million units, securing a 14% market share.

Gizchina News of the week

Oppo and Vivo claim number 4 and number 5 respectively

OPPO and vivo, two other Chinese brands, also maintained their positions in the top five with market shares of 8% and 7% respectively. In fourth position is OPPO with a shipment of 23.7 million units. Vivo took fifth place with 20.8 million shipments.

Apple dominates in terms of profitability, but Android brands are catching up in terms of prices

Despite the rise in market share of the Android camp, Apple continues to dominate the industry in terms of profitability. The report shows that the iPhone maker earns a staggering 90% of industry profits thanks to its ability to command premium pricing.

The average selling price (ASP) of the iPhone in the first quarter of 2024 is $900 (approximately ¥6,517), significantly higher than the competition. Samsung’s ASP was $336 (approx. ¥2,430), while OPPO, Xiaomi, and vivo had ASPs of $257 (approx. ¥1,860), $211 (approx. ¥1,530), and $159 (approx. ¥1,151), respectively.

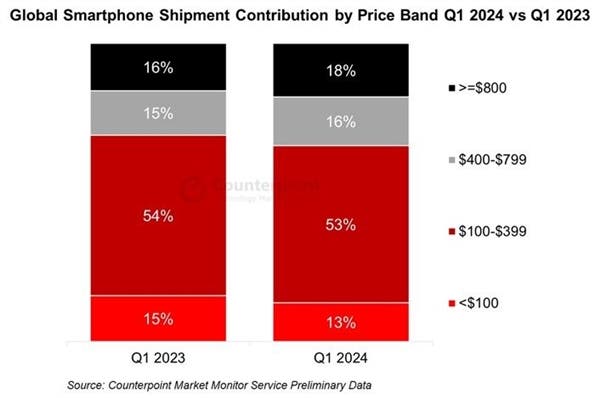

However, Android brands are slowly catching up on price, with the premium segment (above $800) growing the fastest and accounting for 18% of smartphone shipments in the first quarter, up from 16% in the same period last year. That suggests consumers are increasingly willing to pay more for high-end Android devices, challenging Apple’s dominance of the premium market.

Emerging markets drive growth, Europe leads recovery

The report also highlights the role of emerging markets in driving the overall growth of the smartphone industry. These markets, particularly in Asia and Africa, continued to maintain strong momentum, contributing to a 6% annual increase in global shipments.

In addition, Europe, particularly Central and Eastern Europe, saw the fastest growth compared to the difficult period in the first quarter of 2023. This recovery in the European market is a positive sign for the industry as it indicates a broader global recovery.

Smartphone revenue hits all-time high

The growth in smartphone shipments has also translated into a significant increase in industry revenue. In the first quarter of 2024, global smartphone revenue grew by 7% year-on-year, reaching an all-time high for the first quarter. This revenue growth can be attributed to growing demand for premium devices, as evidenced by faster growth in the $800+ price segment, which now accounts for 18% of total smartphone shipments.

Conclusion

The global smartphone market showed a strong recovery in the first quarter of 2024, with Samsung reclaiming the top spot and Xiaomi leading the Android camp with impressive growth. While Apple continues to dominate in terms of profitability, Android brands are making inroads into the premium segment, challenging the iPhone maker’s dominance.

Growth in emerging markets and a recovery in Europe also contributed to the industry’s overall performance, with global smartphone revenue reaching its highest level in the first quarter. As the market continues to evolve, it will be interesting to see how leading players adapt their strategies to maintain their competitive edge in this dynamic landscape. What do you think of Samsung’s recovery? Let us know in the comments section below

Top 5 smartphone brands globally for Q1 2024 – Samsung is No. 1